In today’s financial environment, everyone wants to secure a part of their income and create a strong future fund. Whether you are a salaried employee or a small business owner, planning for savings and safe investment is very important. The Post Office Recurring Deposit (RD) Scheme 2025 is one of the best government-backed small savings options that helps you turn small monthly investments into a big lump sum with guaranteed returns.

What is Post Office RD Scheme?

The Post Office Recurring Deposit (RD) Scheme is a small savings plan under the Government of India. In this scheme, you need to deposit a fixed amount every month for a tenure of 5 years. Since it comes with complete government guarantee, your money is 100% safe. At maturity, investors get their invested amount along with assured interest.

Key Features of Post Office RD Scheme

- Scheme Tenure: 5 years (can be extended further)

- Minimum Deposit: ₹100 per month

- Maximum Deposit: ₹5000 per month

- Interest Rate: 7.6% annually (compounded quarterly)

- Eligibility: Only Indian residents can open an account

- Documents Required: Aadhaar card, PAN card, address proof, passport size photo

- Where to Open: Nearest Post Office branch

Interest Rate & Compounding Benefits

Currently, the Post Office RD Scheme offers an interest rate of 7.6% per annum, calculated on a quarterly compounding basis. This means you earn interest not only on your principal but also on the interest already credited, leading to higher maturity value.

Post Office RD Scheme Maturity Value (Example)

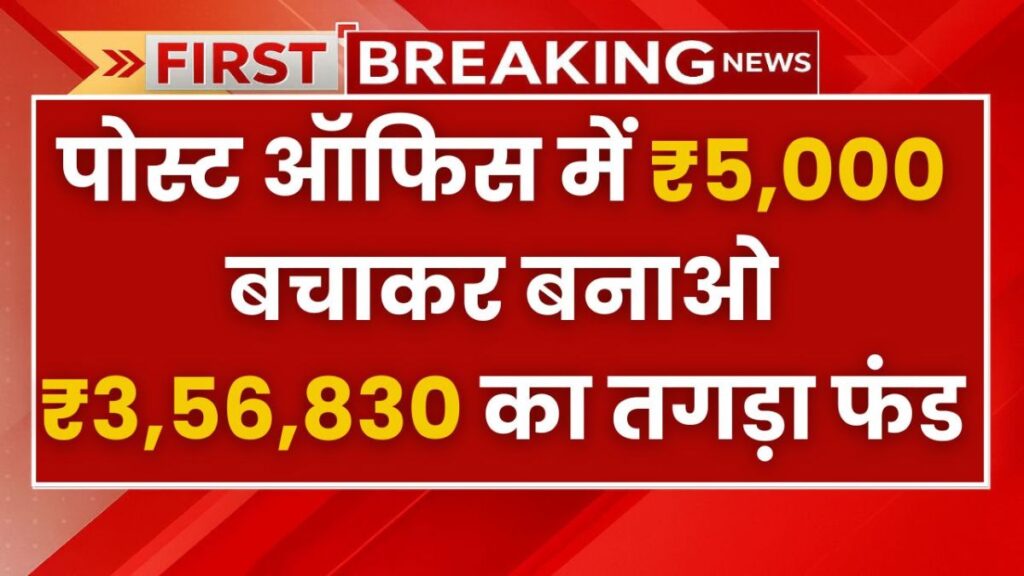

If you deposit ₹5000 every month for 5 years, your total investment will be ₹3,00,000. With compound interest, you will receive around ₹3,56,830 at maturity.

Similarly, if you invest ₹8000 per month for 5 years, you will get approximately ₹5,70,929.

| Monthly Investment | Total Investment (5 Years) | Maturity Amount (7.6%) |

|---|

| ₹5000 | ₹3,00,000 | ~₹3,56,830 |

| ₹8000 | ₹4,80,000 | ~₹5,70,929 |

Benefits of Post Office RD Scheme

- 100% Safe & Secure: Backed by Government of India

- Guaranteed Returns: Fixed interest rate with no market risk

- Best for Small Investors: Start with as low as ₹100 per month

- Future Financial Support: Ideal for children’s education, marriage, or house construction

- Encourages Regular Savings: Builds financial discipline with monthly deposits

How to Open a Post Office RD Account?

- Visit your nearest Post Office branch.

- Fill out the RD account opening form.

- Submit required documents – Aadhaar, PAN, address proof, and photographs.

- Once verified, your account will be opened, and you will get a passbook to track deposits and interest.

Conclusion

The Post Office RD Scheme 2025 is a perfect choice for those looking for a safe, reliable, and government-backed savings plan. With fixed returns, quarterly compounding, and complete security, this scheme is still one of the most trusted small savings instruments in India. If you want to build a strong financial backup with just a small monthly investment, this scheme is highly recommended.